Here is the repost from the new Liars and Cheats EXPOSED blog at FTC complaint about Experian refusal to investigate factual credit disputes and the documentation and correspondence is posted there.

My client actually INCLUDED a copy of his drivers license and utility bill with his factual disputes AND Experian provided him with his credit report prior to receiving the disputes.

Trans Union and Equifax processed the disputes, but on 1/20/10, Experian not only refused to investigate, but also made the most bizarre and FALSE accusation:

We received a suspicious request regarding your personal credit information that we have determined was not sent by you. This could be deemed as deceptive or fraudulent use of your information. We have not taken any action on this request. Any future requests made in this manner will not be processed and will not receive a response. Suspicious requests are taken seriously and reviewed by Experian security personnel who will report deceptive activity, including copies of letters deemed as suspicious, to law enforcement officials and to state or federal regulatory agencies.

The SCAN of the 1/20/10 Experian notice.

We hoped that the law enforcement and regulatory agencies would contact my client after receiving reports of this fraud from the Experian security personnel. However, my client was not contacted by anyone.

On 4/19/10, my client submitted his complaint to the Federal Trade Commission.

On 5/3/10, he wrote to Experian with the following requests:

- Identification of all law enforcement and agencies Experian contacted regarding his disputes.

- The Experian explanation of how it determined that fraud was committed.

- Deletion of the incorrectly reported and disputed LVNV accounts (this will be addressed in detail at the new LVNV blog)

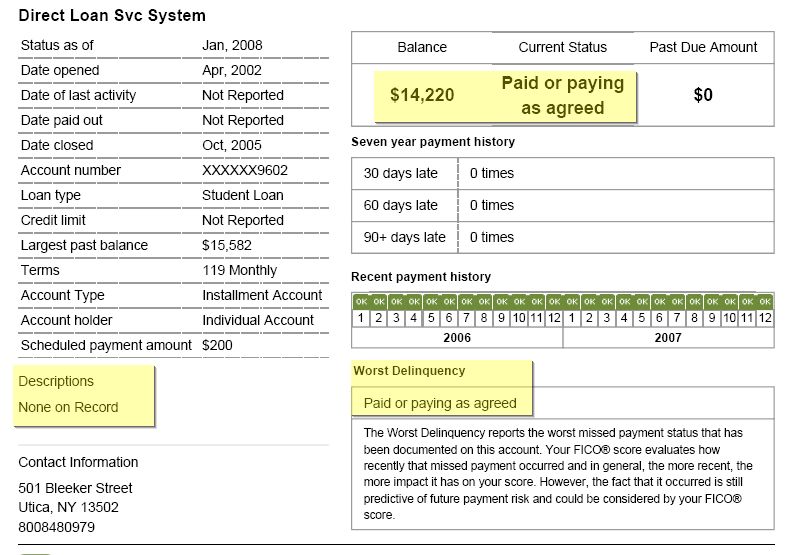

- Correction of the student loans. This is a known systemic problem as all CRAs report the “high balance” as the INITIAL loan amount and they refuse to include the DEFERRED interest that’s added to the loan amount every month.In 9/08 I explained in detail how this INCORRECT reporting lowers FICO scores:

Credit bureaus and Sallie Mae REFUSE to correct student loan high credit reporting

- Deletion of several derogatory accounts because Experian does NOT disclose the scheduled deletion date. Presumably, the accounts are not scheduled for deletion.

I can’t wait for the response from Experian and it sure would be nice if the FTC actually contacted Experian as per their new policy, for details please read How to File Complaints with the FTC and Other Regulators.

Of course we will update with the results of disputes at the Liars and Cheats EXPOSED blog:

FTC complaint about Experian refusal to investigate factual credit disputes

I’d like to hear from others who received this bizarre Experian decline to investigate and you can post comments at Liars and Cheats EXPOSED.