Here we go again, another student loan Experian reporting problem and insane investigation results along with SYSTEMIC false and incomplete Afni collection reporting and strange Experian legal advice. My email to attorney Chang (Jones Day, counsel for Experian in my case against it) is posted below.

1) Experian’s refusal to report the rehabbed student loan as “paid as agreed” and refusal to update the 2/07 balance.

This student loan was rehabbed and it is correctly reported as paid as agreed by Trans Union.

My client disputed with Experian:

3) The Dept. of Education loan was rehabbed and must be reported as paid as agreed with the current balance.

The 8/24/09 Experian investigation results:

I sure do NOT see any updated information:

The account is reported as derogatory:

Status: Claim filed with government/Never late.

Account history: Claim filed with government as of Feb 2007.

Creditor’s statement: “Student loan permanently assigned to government.

Don’t assume that it is a positive account because it’s reported as “never late.” This is how they TRICK people into NOT disputing extremely derogatory data.

In fact, this student loan is as derogatory as any charge-off.

HINT: The Experian direct report lists derogatory accounts in the beginning and derogs are only reported for 7 years.

This account is scheduled to continue on record until November 2013.

Apparently the account became permanently delinquent in 2006. If it was a positive account, it would be reported for 10 years from payment in full.

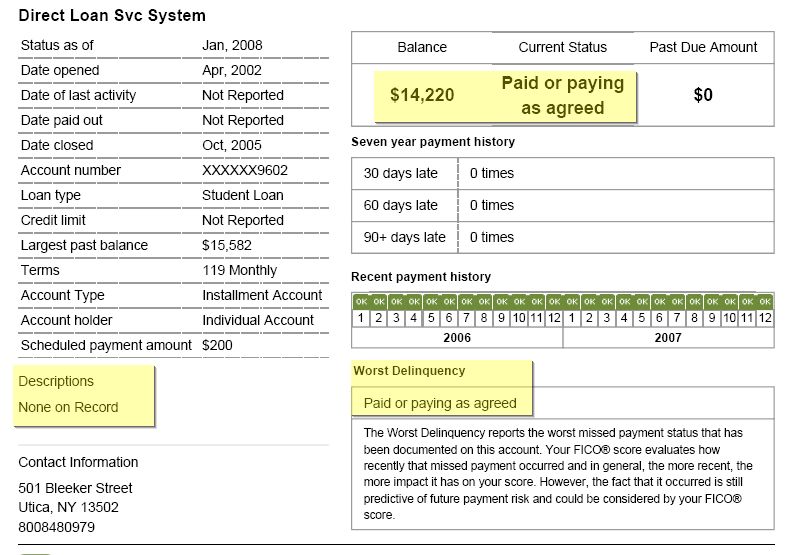

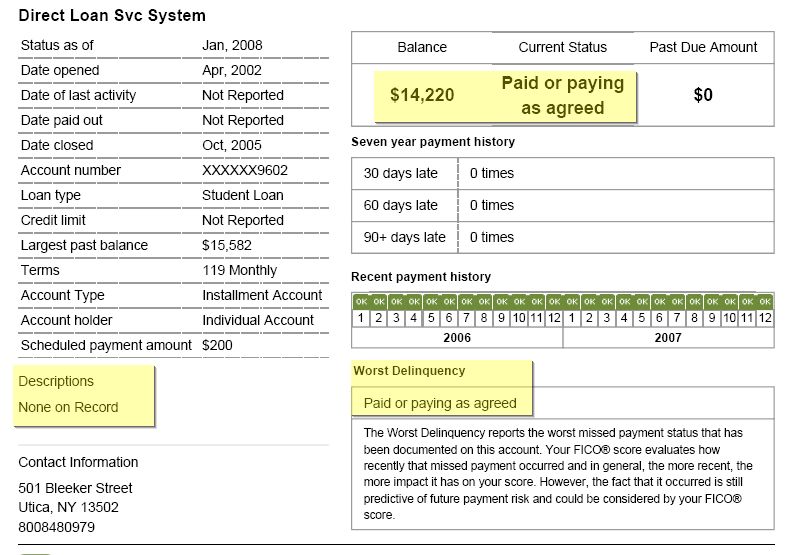

Please note that the account was LAST REPORTED to Experian in 2/2007 with the $15,500 balance. My client has been PAYING the account and it is CORRECTLY reported by Trans Union, although the reporting also has not been updated since 1/2008.

From the TU myFICO report in 7/09:

Note the LOWER BALANCE and that there are NO derogatory remarks.

However, the government should obviously update the balance every month. So many people start paying their defaulted student loans because they are promised that the loans will be reported as POSITIVE accounts after 12 timely payments. As so often, the government breaks its promises.

2) Experian’s odd investigation results, refusal to delete collections that were NOT validated and SYSTEMIC false and incomplete reporting of collections.

My client also disputed the Afni collection.

2) Please delete these disputed collections: AFNI, Kenneth Eisen & Assoc and National Credit Adjuster. AFNI and National Credit failed to provide any documentation for the accounts after my disputes.

The 8/24/09 Experian results state that the account was “reviewed” and the Afni reporting states: “This item was verified and updated on Aug. 2009.”

Most important: Experian does NOT report the DATE of the DEFAULT to creditors.

It also reports MANY collections incorrectly as installment loans such as this Afni collection, reports OBVIOUSLY FALSE status dates and it allows collectors like AFNI to report FALSE information about DISPUTED and usually undocumented collections.

Afni has been sued by the MN AG and even featured in a TV news report as a collector notorious for collecting bogus accounts.

Since the credit bureau profits INCREASE as they report false and misleading derogatory information, they condone the Afni reporting.

The Experian employees commit perjury with impunity and claim that Experian implemented procedures to ensure that credit reports are as accurate as possible. The Experian INVESTIGATION RESULTS prove that Experian in fact takes many measures to deliberately DESTROY consumers’ credit rating, to confuse and deceive consumers with strange statements and it even gives the bizarre legal advice claiming that the INCORRECT reporting complies with the FCRA!

NOBODY should have to pay me to TRY to explain the absurd credit bureau investigation results.

Please see my published FTC / state AG complaints at http://credit-reporting-collection-ftc-complaints.info/ Unless Experian changes its SYSTEMIC bizarre credit reporting practices, the Experian collection reporting will become another published regulatory complaint.

My email with many questions to attorney Chang:

(more…)